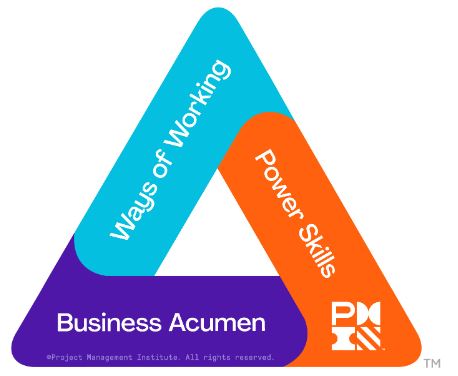

PMI Talent Triangle: Business Acumen (Strategic and Business Management)

Welcome to the PMO Strategies Podcast + Blog, where PMO leaders become IMPACT Drivers! Today we are talking about how we can best incorporate the best of project portfolio management into what the PMO does. Especially from a services and capability perspective. I am honored to have a guest with me that I consider a friend and a colleague and one of my favorite thought leaders in this space, Andy Jordan. Andy is the president of Roffensian Consulting S.A., a Honduras based management consulting firm with fabulous views of the water every single day. I’m so jealous and he has that. Andy’s organization has a strong emphasis on organizational transformation, portfolio management, and PMO specifically. Andy was a part of the PMO IMPACT Summit last year and he was one of our highest rated speakers, so we brought him back to the Summit again this year. You can get all of the information on his upcoming presentation and more information about Andy at PMOIMPACTSummit.com.

Project Portfolio Management and the Role of the PMO

Laura: Andy, I would love to get your perspective on project portfolio management and the role of the PMO, and why it’s important for us to be thinking differently about that role?

Andy: I think there is a lot of good stuff that has been done with portfolio management and PMOs have been at the heart of that. But there is still a long way to go. Fundamentally a lot of organizations don’t quite have the right grasp of what portfolio management should be, and I think PMOs can help solve some of those problems.

Laura: Why don’t we give some perspective here and talk a little bit about what do we mean when we’re talking project portfolio management.? Let’s go a hundred thousand foot view and then maybe we can talk a little bit about what’s working, what’s not working and the role of the PMO and all of that.

Andy: Sometimes the easiest way to think of what project portfolio management is to think about what it isn’t. It’s not a roll up of projects and programs that you just so happen to be doing right now. The portfolio has to come first. The portfolio is the vehicle by which an organization executes on strategy. So if the executives say, “all right, this year we’re going to increase our revenue by 5% we’re going to reduce our costs by 10% we’re going to increase customer satisfaction by three points,” whatever it might be. Those are the goals and objectives. The portfolio is the vehicle we use to actually deliver on that. We’ll have projects that sit within that portfolio, but those projects can come and go. It’s the portfolio that’s key and we have to make sure that the portfolio delivers results. Delivers results is the key piece here. We’re not interested in delivering projects. We do, but we’re interested in delivering business outcomes as a result of those projects. We’re interested in improving revenue, decreasing costs, increasing customer satisfaction. That’s the measure of success for the portfolio.

Laura: Yes. I’m so glad you said that because I feel like I am constantly talking about we’ve got to stop emphasizing so much the outputs we’re creating and shift our focus to the outcomes we’re driving. As PMO leaders, it is super important that we help facilitate that mindset shift in our organization. Often times, PMO leaders will get so caught up in the “how manys” and the “how much” versus the IMPACT they’re making. When if we think more about the outcomes we’re creating for the organization and driving towards those outcomes, we will be so much more aligned with where the organization is trying to go and where they’re thinking.

Andy: Absolutely. You know, if you’re an investor in an organization, if you own shares in a company, do you care that they did 10 projects this year or a hundred or a thousand? Or do you care that they achieved all of their goals, that they increased their revenue, that they reduced their costs, that their profitability was high, that the dividend they’re paying to shareholders this year is greater? That’s what matters. You don’t care whether or not they did 99.8% process compliance or whether or not 89.67% of projects finished on time. Who cares? It doesn’t drive value.

Laura: Yes! I think one of the things that we need to think about that you just mentioned there was the whole concept of “we don’t care about the on time and the on budget so much” and I think that that leads to some very important discussion around let’s step away a little bit from the triple constraint. Not that it’s not important to track that stuff, but that’s not all we should be measuring. We need to be measuring the outcomes that we’re creating and if we’re thinking about this triple constraint as having to get as much on time on budget as possible, we can protect that golden triangle to the detriment of the actual project delivering its outcomes. What if part way through the project do you find that if you don’t add one key feature, you’re really not going to be able to achieve the business goal? We are fiercely protecting that triple constraint to the detriment of getting to those outcomes.

Andy: Yeah, absolutely. I mean, think about projects. The portfolio from the concept of an organization and organizations got a certain amount of money that it can spend on projects every year. Let’s call it $100 million. If it commits $5 million to one particular project, it needs to get 5.5 or $6 million or something back in order to generate a return on the investment. Otherwise, it’s going to look at taking those $5 million and taking them somewhere else. There’s only a hundred million total to spend, so you’ve got to find the best way to do it. If you then give that $5 million to a project manager who forgets that his job is to turn that $5 million into 5.5 or 6 million and instead it says, I’m going to deliver all of my approved scope by the date I’ve been told to, you know, for whatever resource costs you’ve given me, if that’s what they care about and the world has moved on, which let’s face it, it will have done and now all of a sudden that 5 million turns into $4.8 million of revenue. The CEO is not going to promote you because you delivered on time, on scope and on budget. The CEO’s going to fire you for wasting $200,000 and the opportunity to generate more.

Laura: Yes. Let’s talk a little bit about where we are today with project portfolio management and what’s working and what’s not working from your perspective?

Andy: Well, let me say per project portfolio management today is better than when we didn’t have it. Things are certainly better than they were five or 10 years ago. So let’s acknowledge that. But that’s the end of the good news. It’s nowhere near where it could be or where it needs to be. The moment project portfolio management is still a little bit of a bolt on overlay. We do project planning the way we’ve always done project planning. We do project execution the way we’ve always done project execution with maybe a little bit more of a benefits focus. Then we try and sort of tie those two together or bolt them together a little bit with portfolio management. We’re not doing it that effectively because we’re not truly integrating everything. We’re still looking at the world from the bottom up. When you start planning the portfolio, you don’t start with what I said that the portfolio comes first. The idea of generating the return on investment, you start by doing business cases for individual projects and then trying to choose the best one. So it’s still bottom up planning. It’s not strategic down.

Laura: That’s a really good point because that’s how many portfolios are created. I’ve seen PMO leaders doing this where they consider all of their projects their portfolio. As opposed to what you’re suggesting, determining the business outcomes we’re trying to drive and then the projects come from that.

Andy: Yeah, absolutely. If you think about how an organization spends its money, the vast majority of the money that it’s got available has to go into operations. It has to go into paying the salaries of employees, to work in progress, raw materials, you know all the, the execution of stuff that it does. There’s only a small percentage that’s available for investment in projects. Of that small percentage, whole bunch of that is already tied up with stuff you have to do. Regulatory compliance, keep the lights on, commitments that you’ve made in previous years, so there’s only a tiny, tiny fraction that’s actually available for new project investments. That’s what you have to focus on is making sure you’re getting the best possible return on investment for that limited amount of money. Not that you’re doing a whole bunch of really exciting projects that the C-suite wants to do, that doesn’t matter. That doesn’t help the organization move forward. You’ve got to turn it on its head, start with strategy and drive everything from there.

Laura: We started talking about investments a little and I want to just make it super clear for everyone what the role of the PMO is and what the role of the project is. I’m often saying to my students in my IMPACT Engine PMO program that they must ensure they’re creating the highest possible return on investment for the organization. Let’s talk a little bit about this ROI or return on investment thing. I want to go deep and be thorough here because I feel like this is so important and one of the most critical mindset shifts that PMO leaders must embrace.

Andy: I mentioned, organizations have a limited amount of money to spend, right? They have to generate the best possible return on that. Just as we all do as individuals, we have a limited amount of money to spend. With that money there’s some things we have to do. We have to buy groceries, we have to pay the utility bills, we have to pay a mortgage or rent, whatever it might be. And then we’ve got a little bit of money that we can choose to spend in other areas, but we still want to get a return from that money. It may not be a financial return. Yes. Some of it will go into our retirement savings, which will generate hopefully a return for us down the road. Some of it may go into a savings account to pay for the next vacation. Then we start thinking about how we spend that discretionary funds. Do we go out for a meal or do we put a bit more money away for a vacation? Both the vacation and the meal creates personal value. The same thing happens in organizations. Organizations invest in projects sometimes to make money or frequently to make money, especially in the private sector, but sometimes that’s an indirect value return. Sometimes it’s because it increases customer loyalty or it attracts new customers, which then drive longer term value.

Laura: That’s the important part it’s still a return. It is of value to the organization.

Andy: They are spending a fixed amount of money to generate a return, a value that is more than the amount spent. Easy to measure that in purely financial terms. Life’s not always that simple, and some industries are not driven by money, right? We’ve got the not for profit sector where in fact, not for profit. A really good example, you’ve got very limited amount of money coming in. You want to spend as little as possible, but you want to do as much good as possible. Whatever it is that your trying to add value to, whether it’s Third World Development, medical research, animal care, or whatever it might be. You’re trying to spend as little as possible to do as much good as possible. That’s a return on your investment. Back to the PMO. The PMO is in charge of is delivering, is driving the process of making sure project related work aligns with the kind of return that we have to get. The organization says these are our goals, these are the areas we’re gonna focus on. This is the kind of area where we want to drive value. If the PMO is not making sure that happens, i.e. that the work is generating the right kind of value and that the best possible return is being created. It’s failing the organization. At the end of the day, the currency of the world is, is financial. That’s how all of us exist. I don’t do this kind of thing because I absolutely love project management alone. Yes, I love project management, pmo, and portfolio management, but at the end of the day, it’s an investment of my time and effort in return for some kind of financial reward. If that doesn’t happen, then you can’t afford to live. You can’t afford to maintain the equipment that allows it to happen. There has to be some kind of financial benefit no matter how valuable or how worthwhile the work that you do is. If a PMO doesn’t recognize that, then it’s not going to have its eye on the ball. It’s not going to be delivering the kind of benefits that it needs to for its employer.

Laura: Exactly. Every person listening to this, if they are receiving a paycheck, they are getting a return for their investment in time. It’s the “worth that factor”. That’s what I often call it. I’m like, okay, you don’t want to call it ROI, call it the “worth that factor.” Is it worth investing our time, energy, resources to get a return? Whether that return is financial in whole or in part or it is some other value or perceived value that can help you better society. This is really important to help with that mindset shift for PMO leaders. For a deep dive and a road map on this definitely head over to PMOIMPACTSummit.com and register for the free conference. Is there anything else that you think is important for PMO leaders to do right now to start making that shift to a more portfolio management driven decision making process in the organization?

Andy: When we talk about PPM, project portfolio management, the thing they can do right now is to stop focusing on the project part and start focusing on the portfolio part. It’s about the portfolio. That’s what drives the value. The projects themselves are secondary to the portfolio. To bring it back to money, think about your retirement funds, your retirement portfolio. You have individual projects, individual stocks and shares in there, but you care a lot more about the overall return on investment of the portfolio. It’s the portfolio that matters. If you start that mindset, if you start thinking in terms of that, then you can start that journey towards delivering sustainable value through project portfolio management 2.0.

Laura: Oh, that’s great. Well, Andy, as always, it is an absolute pleasure and an honor to have you a part of the PMO Strategies Podcast and the PMO IMPACT Summit. Thank you for your time today.

T hanks for taking the time to check out the podcast!

hanks for taking the time to check out the podcast!

I welcome your feedback and insights!

I’d love to know what you think and if you love it, please leave a rating and review in your favorite podcast player. Please leave a comment below to share your thoughts. See you online!

Warmly,

Laura Barnard